When meeting with prospective clients over the years, we’ve found that most B2B marketers fall into one of three distinct groups:

- They don’t have a loyalty program yet.

- They have a program in place, but feel it’s underperforming and want to change the situation.

- They had a program in the past, but discontinued it because “it didn’t work.”

Often, the situation the company finds itself in is due to a lack of program experience or the absence of the tools or technology necessary for creating and managing a best-in-class B2B customer loyalty program. This is why full-service loyalty program providers like Lift & Shift exist—to ensure B2B loyalty programs are well-structured and professionally managed for optimal results.

But the DIY mentality is pervasive in our culture, with many companies adopting this approach when looking to introduce a B2B loyalty program. They license off-the-shelf loyalty software or, in extreme instances, attempt to invest the time and resources to build the required technology to set up and manage a program; however, their lack of experience ultimately impacts its success.

No matter what path a company takes to introduce its own B2B loyalty program, here are

5 common mistakes to avoid when building and managing a successful customer reward program:

1. A business too focused on program costs instead of program ROI

It’s essential to recognize that a customer loyalty program is a highly efficient strategic sales tool that an organization and its sales team can use to leverage historical sales data to drive incremental sales and profits with existing customers (LIFT) and attract new customers (SHIFT).

A great loyalty program will be structured so that the reward costs optimize the financial benefits to your company.

They are not designed to minimize reward costs. So long as the reward program is developed with a performance-based reward structure, with reward offers tied directly to targeted purchases from existing and new customers, the program will generate a positive ROI for your company. So often, after the program’s first

ROI review, we’ll have clients ask us, “How do we get more customers using the program and earning rewards in order to get more of these results?” A sure sign that they have stopped worrying about the reward costs and have become focused on the reward program’s positive impact on their bottom line. After that change in attitude, the program ROI really takes off as the company is prepared to make more investments in something they can measure. Perhaps because the ROI of most sales and marketing tactics is virtually impossible to measure, most sales and marketing decision-makers focus on the cost of loyalty programs rather than what they can deliver.

2. The program is operator-friendly when it should be customer-friendly

The net result is quite predictable: an overly simplified one-size-fits-all reward structure, not rooted in today’s account-based marketing realities. Instead, every customer is presented with the same reward rules and offers. This is because the program manager lacks the time or ability to effectively analyze all customers’ historical purchasing data and develop personalized reward rules and offers tied to growth objectives, purchasing gaps, order slowdowns, or any other strategic sales issues or objectives the company has for each customer or account.

Another common failing is a lack of investment in program “builds”—the automated program tools that make the customer experience as positive as it should be. Too often, programs lack a detailed reward website with an account summary, a personalized monthly reward statement, and a customer service contact—all of which are crucial to making it easy for customers to participate in the reward program, ensuring it can have the desired impact on their purchase behavior.

Lastly, there are common reward program features that may seem like a good idea to the program operator but not to the customers, such as:

- Premature point expiry—where points expire after only 6 or 12 months. This often aggravates loyalty program customers, many of whom intend to continue purchasing to accumulate enough points for a big-ticket reward—until they realize they will never reach their goal due to the short-term points expiry rules and stop participating in the program.

- A fee to join the program—This will ensure that most customers with the greatest opportunity to be influenced by the reward program (and increase purchases) won’t bother to join in the first place.

3. Program irrelevance for customers

Most customers use multiple vendors in a category for various reasons. A B2B loyalty program can tap into existing customer spending data. This shows both what they buy now and what they do not buy. It may reveal upsell or cross-sell opportunities by using rewards to reinforce current spending and promote retention. Also, use them to capture the spending that is currently going to competitors for growth and new customer acquisition.

The most crucial error in loyalty marketing is not utilizing customer data to present customers with relevant and realistic purchasing opportunities they can take advantage of to earn desirable rewards, thereby directing more of their total business to you rather than to your competition, making them a more loyal customer.

If a customer lacks a clear, accessible path to rewards, they may struggle to increase their spending with you. This makes it more difficult to achieve the reward value. As a result, customers lose interest and abandon the program. Once this happens, there is little chance of reengagement. Each disengaged customer lowers the program’s value and ROI.

Another key feature needed for engagement is a

wide reward array. A company will have hundreds or thousands of customers. Each will have different tastes, preferences, or situations.

Many program operators limit the reward selection to their own products or an account credit.

This is a mistake!

Your products should always be included in any good B2B loyalty program, but they should not be the only options for customers participating. Some customers may like gift cards. Others want a trip. Some participants may not accept personal rewards, so workplace-oriented rewards are often the best option for them.

It’s crucial to have something for every type of customer and business.

When selecting reward options, ask:

What will best motivate a certain customer to buy more from us? If it’s a gift card or a trip instead of an account credit or free product, so be it.

The goal of the loyalty program is to increase each customer’s lifetime value to your company, not simply to push your own product upon them; that is simply too limiting.

4. Poor program promotion or awareness

A healthy participation rate among eligible customers is typically about 30-35% by the end of year 1 and 75-80% by the end of year 3. No program ever realizes 100% customer participation.

Some organizations will downplay a program because it may not be available to all customers, and they don’t want to upset ineligible accounts. This is unnecessary.

Any B2B customer loyalty program can be easily structured to reflect the different types of customers. A growth-based reward structure rewards all customers who grow their business, allowing both VIP accounts and smaller accounts to benefit in one way or another. Other accounts may simply never be a good fit, such as government agencies or large organizations where a B2B buyer is unable to accept a personal reward. Still, these types of customers usually receive other benefits due to their size.

It’s simply a matter of ensuring the sales team understands who can participate, who is ineligible, and why, and manages the message effectively with all customers.

The program must be continually promoted to maximize ROI. All customer touchpoints—website, ads, sales materials, invoices, vehicles—should mention the reward program and include a call-to-action for sign-up and participation.

Assign specific enrollment targets for the sales team each year to measure and drive customer sign-ups.

5. No program evaluation or re-tooling

Ideally, any loyalty program should be structured appropriately from the outset, with program rules and parameters that will incentivize customers to direct more business to you and become more valuable (in a cost-effective manner) for your company, thus delivering optimal ROI.

BUT if the initial program structure does not appear to be working—STOP and evaluate why. Use this insight to refine the program, adjust the rules, and reengineer it accordingly. The beginning of a new fiscal year is an ideal time to introduce changes to a B2B loyalty program, and these changes can often be presented as positive for the customer group.

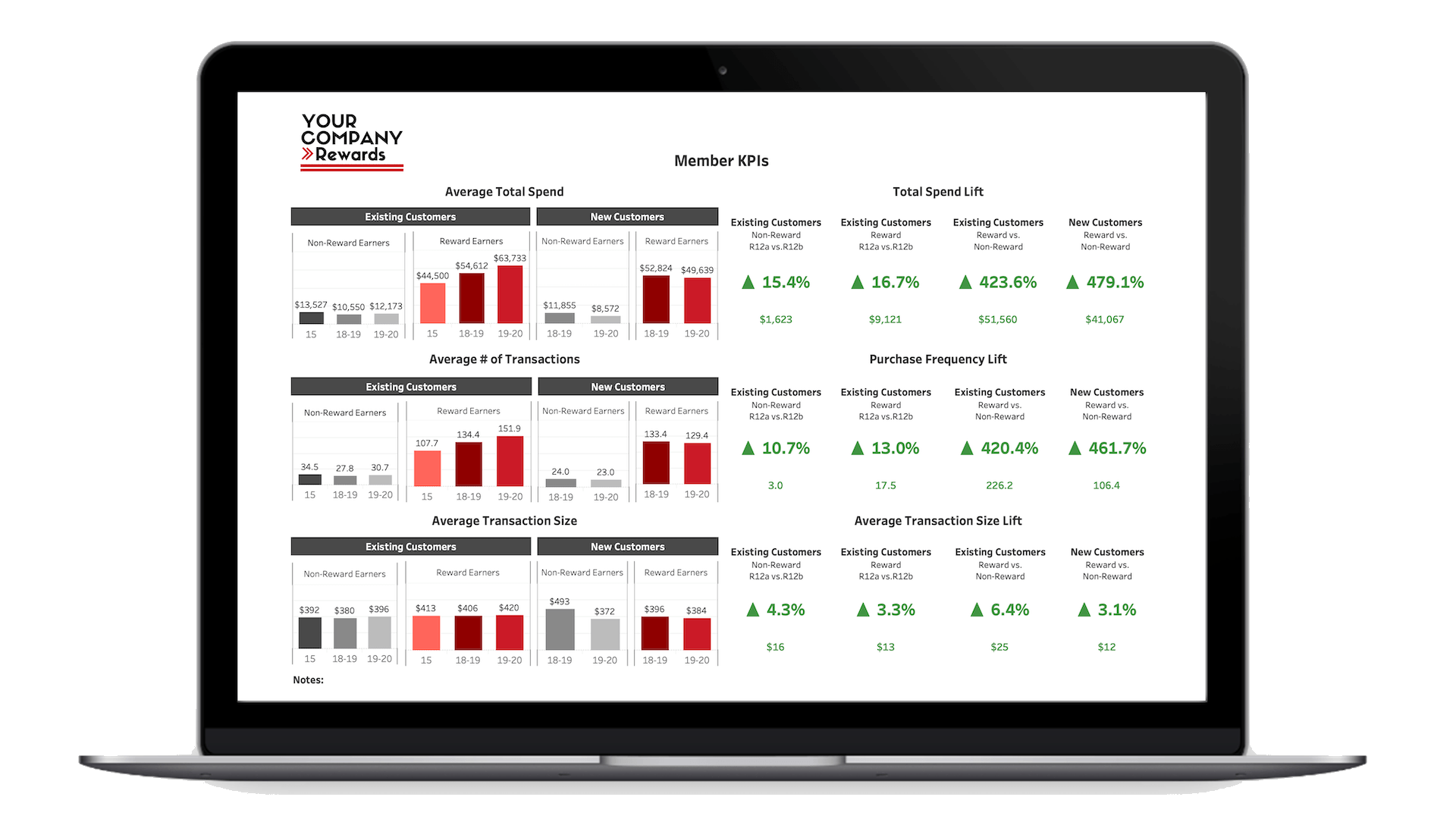

The most important metric to be evaluated will be customer growth—have the reward-earning customers changed their purchase behavior in a meaningful or desired way? Different companies face different challenges or opportunities, so the definition of “meaningful” will vary, but business goals can include:

• Total sales in a month/quarter/year

• Purchasing more frequently

• Larger transaction sizes

• Purchasing more product or service categories

• Migrating more purchasing online

• Picking up a new product line

• Acquiring new customers

• Building brand awareness

Too often, we will hear a marketer state that the “customer probably would have made those purchases anyway,” implying the incentive program had little or no impact and questioning its value.

One way to ensure this is not the case is to compare reward-earning customers to similar customers who are not participating in the program. You should see a significant difference in purchase metrics between the two groups.

It's also highly useful to solicit input from key program stakeholder groups—your existing customers, your sales team, and channel partners/ISOs. A B2B customer loyalty program is, first and foremost, a sales tool, so get candid input from all groups.

What do customers like or dislike about your program?

What, if anything, needs to change for them to further change their purchasing behavior?

Similarly, ask your sales team/channel partners to identify the strengths and weaknesses, as well as opportunities, for the program to help them drive greater sales with their customers.

Some ideas or suggestions may not be feasible for implementation, but many will be, so be sure to regularly ask these groups for their opinions and try to incorporate viable suggestions into the program to help evolve it into the corporate profit center it should be.

If you’re looking to introduce a program for the first time, want to improve your B2B customer loyalty program, or have found your team doesn’t have the time or expertise to run a best-in-class loyalty program in-house, contact our team at Lift & Shift. We can help you create a winning loyalty program—not just for your customers but also your bottom line.

Lift & Shift™ offers a powerful B2B reward platform that can help your company leverage its sales data to drive incremental purchases with customers and channel partners or motivate sales staff. We work with manufacturers, distributors and service providers to analyze sales data, identifying purchasing gaps and other valuable targeting opportunities.

We create and deliver highly relevant offers to customers, in-house sales staff or sales associates, motivating your target audience to respond, using a wide array of appealing reward options as influencers. Our performance-based reward structures deliver an unparalleled return on investment, with absolutely no wasted budget.

Our customizable reward platform enables clients to easily benefit from a robust loyalty reward program. It's affordable and includes Lift & Shift’s turnkey professional program administration. We take care of everything so you can focus on your key initiatives.

The Ultimate Guide to B2B Loyalty Programs

This article is part of a series covering how growth-based loyalty programs can elevate sales and company profits by incentivizing current customers to spend more, attracting new customers with appealing rewards, and motivating your sales team.